Cca depreciation calculator

The remaining 83333 of. It is fairly simple to use.

Depreciation The Cca Inflation Chapter 7 12 Outline Depreciation Defined Types Of Depreciation Before And After Tax Marr Ucc And The 1 2 Yr Rule Ppt Download

The calculator also estimates the first year and the total vehicle depreciation.

. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. Calculate your CCA claim using the back of Form T777 Statement of Employment Expenses and enter the amount on the applicable line on the front of the form. To calculate capital cost allowance CCA on your depreciable properties use the form that applies to your business.

How to Reduce Your Canadian Small Business Income Tax. Capital Cost Allowance Depreciation Definition. What is the difference between straight-line depreciation and.

Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation. Basic information about capital cost allowance CCA Current or capital expenses declining-balance method fiscal period less than 365 days. Posted in Answers Depreciation Methods.

Form T2125 Statement of Business or Professional. Cash flow after deprecition and tax 2. At depre123 try out our Free Depreciation Calculator and check out our cloud based fixed assets application.

To calculate CCA list all the additional depreciable property your business has bought this year. The algorithm behind this car depreciation calculator applies the formulas given below. Line 22900 was line 229 before tax year 2019.

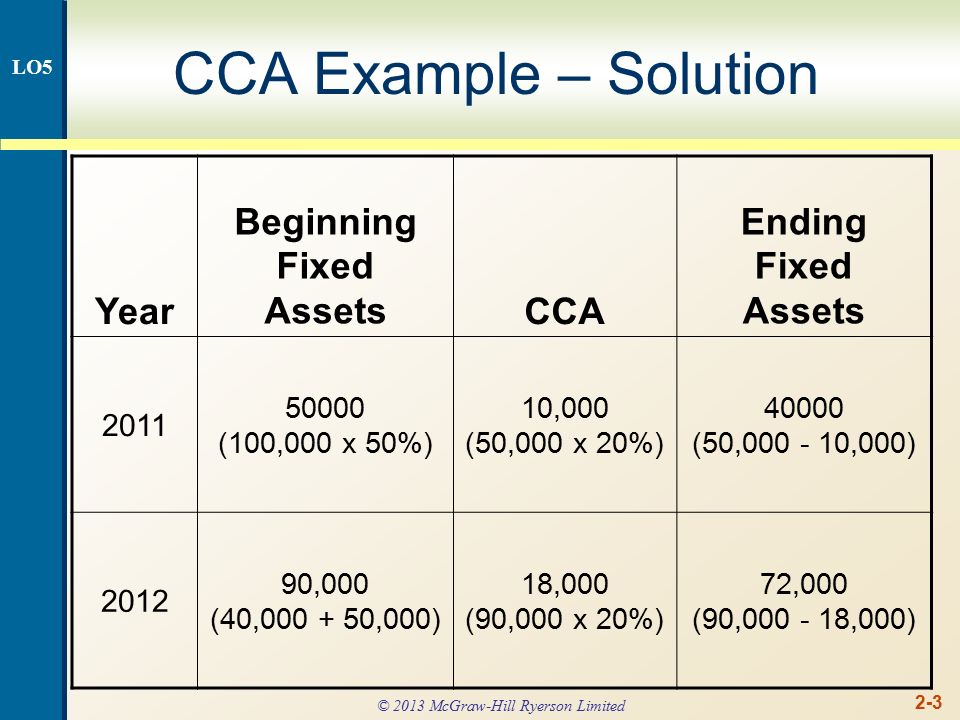

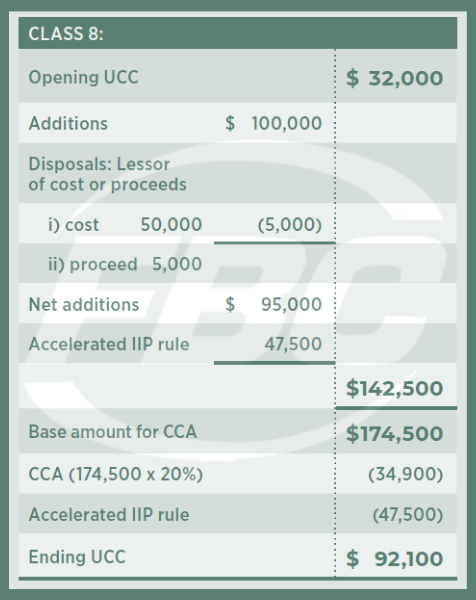

We will even custom tailor the results based upon just a few of. Current years depreciation CCA method 180000 2000000 2 x 10 190000 Historical depreciation 1000000 10 100000 Depreciation adjustment. Capital cost allowance wikipedia.

Available for use capital cost depreciable property fair market value FMV non-arms length transaction proceeds of. All you need to do is. Periodic straight line depreciation Asset cost - Salvage value Useful life.

Capital cost allowance depreciation definition. Best Real Estate Crowdfunding Sites of 2022. Building value 75000 total purchase price 90000 total expenses 5000 part of the expenses that can be added to the cost of the building 416667.

- Total car depreciation for the time. Information relating to capital cost allowance. Car age current time expected to use in years A CCA TET.

Select the currency from the drop-down list optional Enter the. How Straight-Line Depreciation in. Can you claim CCA.

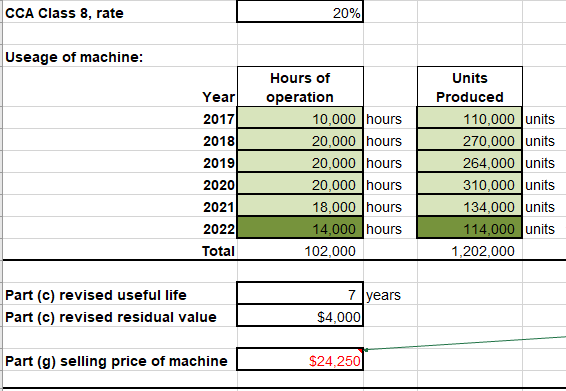

How to calculate CCA. Then determine how much of the purchase cost of each property you can. To calculate your CCA claim you will need to know the meaning of.

The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below. Capital Cost Allowance Permitted Depreciation Undepreciated Capital Cost Depreciation Rate Canada Revenue Agency Classification Class 1. How much and how to calculate CCA.

Class 1 building acquired.

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Capital Cost Allowance Canada Youtube

Calculating The Capital Cost Allowance Cca Youtube

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

What Is The Purpose Of Cca How Is It Calculated Why Are Items Typically Pooled Into The Same Cca Class Intermediate Canadian Tax

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

Tax Shield Formula Step By Step Calculation With Examples

2

Solved 2 A Given The Following Income Statement Calculate Chegg Com

Capital Cost Allowance Cca For Canadian Assets Depreciation Guru

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

Solved Cca Cca Ucc Straight Line Method Depreciation Chegg Com

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

Cca Calculation Youtube

Some Cca Classes Table Ppt Video Online Download

Capital Cost Allowance For Farmers Fbc